Nvidia Detailed first-quarter profit for its monetary 2024 on Wednesday, with a more grounded than-anticipated gauge that drove shares up 26% in expanded exchanging.

This is the way the organization did versus Refinitiv agreement gauges for the quarter finished in April:

EPS: $1.09, changed, versus 92 pennies anticipated

Income: $7.19 billion, versus $6.52 billion anticipated

Nvidia said it expected deals of about $11 billion, give or take 2%, in the ongoing quarter, over half higher than Money Road evaluations of $7.15 billion.

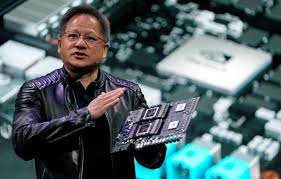

Before the night-time move, Nvidia stock was up 109% such a long ways in 2023, for the most part determined by idealism originating from the organization's driving situation on the lookout for man-made reasoning chips. Nvidia Chief Jensen Huang said the organization was seeing “flooding interest” for its server farm items.

Nvidia's server farm bunch revealed $4.28 billion in deals, versus assumptions for $3.9 billion, a 14% yearly increment. Nvidia said that presentation was driven by interest for its GPU chips from cloud sellers as well as enormous customer web organizations, which use Nvidia chips to prepare and convey generative artificial intelligence applications like OpenAI's ChatGPT.

Nvidia's solid presentation in server farm shows that man-made intelligence chips are turning out to be progressively significant for cloud suppliers and different organizations that run huge quantities of servers.

Be that as it may, Nvidia's gaming division, which incorporates the organization's illustrations cards for PC deals, detailed a 38% drop in income to $2.24 billion in deals versus assumptions for $1.98 billion. Nvidia pinned the downfall on a more slow macroeconomic climate as well as the increase of the organization's most recent GPUs for gaming.

Nvidia's car division, including chips and programming to foster self-driving vehicles, developed 114% year over year, yet stays little at under $300 million in deals for the quarter.

Total compensation for the quarter was $2.04 billion, or 82 pennies an offer, contrasted and $1.62 billion, or 64 pennies, during the year-sooner period. Nvidia's general deals fell 13% from $8.29 billion a year prior.